Careful financial planning plays an important role in preparing for a smooth and happy retirement. This is why it is important to make sure that you are receiving all the tax benefits that you are entitled to from your pension contributions.

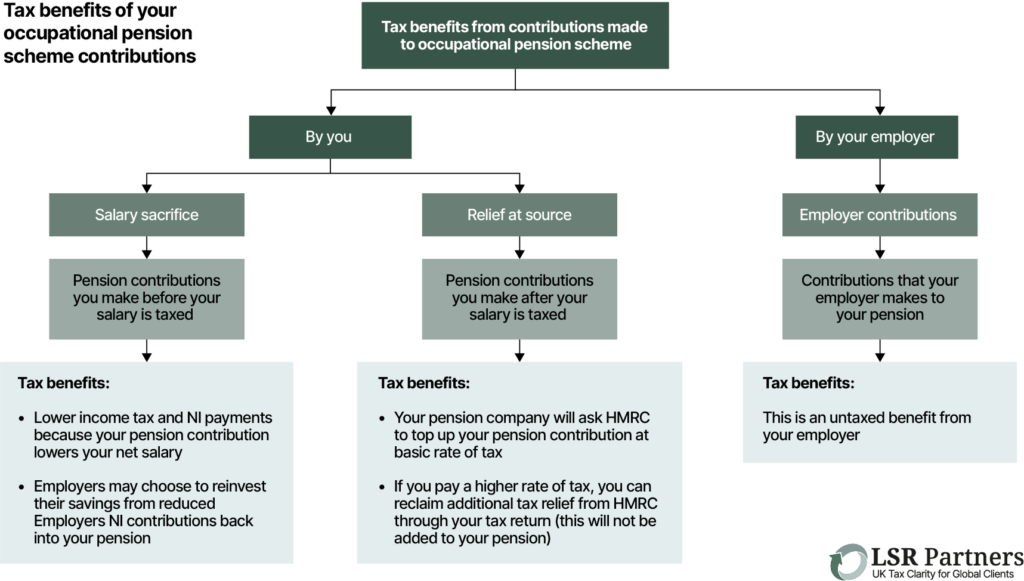

If you have an occupational pension scheme, there are three ways that contributions can be made to your pension:

For each of these, there will be different tax benefits. Below is a quick summary of what those benefits look like.

Salary sacrifice

When you contribute to your pension using the ‘salary sacrifice’ method, your employer will take your pension contribution from your salary before it is taxed. This means that your net salary will be lower. And, because your net salary is lower the amount of income tax and National Insurance (NI) that you have to pay will also be lower.

Relief at source

If you make a contribution to your pension after your salary has been taxed, you will not feel a tax benefit on your salary. However, the benefit you receive from contributing in this way will be a pension contribution top-up at the basic rate of tax from HMRC that your pension company will request for you.

So, for example, if you contribute £200 to your pension, HMRC will top that contribution up by £50 making the total contribution £250.

If you pay a higher rate of tax, you can gain the benefit of additional tax relief if you include your pension contribution in your tax return. However, while doing this will reduce the amount of tax you have to pay on your income, it will not add any more money into your pension pot. So, if you want to use your savings to contribute to your pension, then you will have to do this separately.

Employer contributions

Employer contributions is when your employer contributes towards your pension. This is not taxed so is an untaxed benefit to you.

Pensions, pension contributions and tax benefits can be complicated.

As every individual’s circumstances will vary, we recommend that you seek professional advice to ensure that you are getting all the benefits you are entitled to from your pension contributions to make the most of your pension.

As experts in the UK taxation system we can provide more detailed information and advice about your pension. We want you to look forward to your retirement by helping you plan ahead for your best possible financial future.

Watch the video below for more information on the occupational pension scheme

UK tax clarity for global clients - Pay the right tax in the right place at the right time.

Any questions? Book a consultation!