Simon Roue and Laura Sant unpack the Second Automatic UK Test; the 91-day 'only home' rule that can make you UK tax resident even when your day count looks safe.

One of the most overlooked parts of the Statutory Residency Test (SRT) is the second automatic UK test; a rule that catches out many globally mobile workers and property owners. Here’s what you need to know to stay compliant and confident.

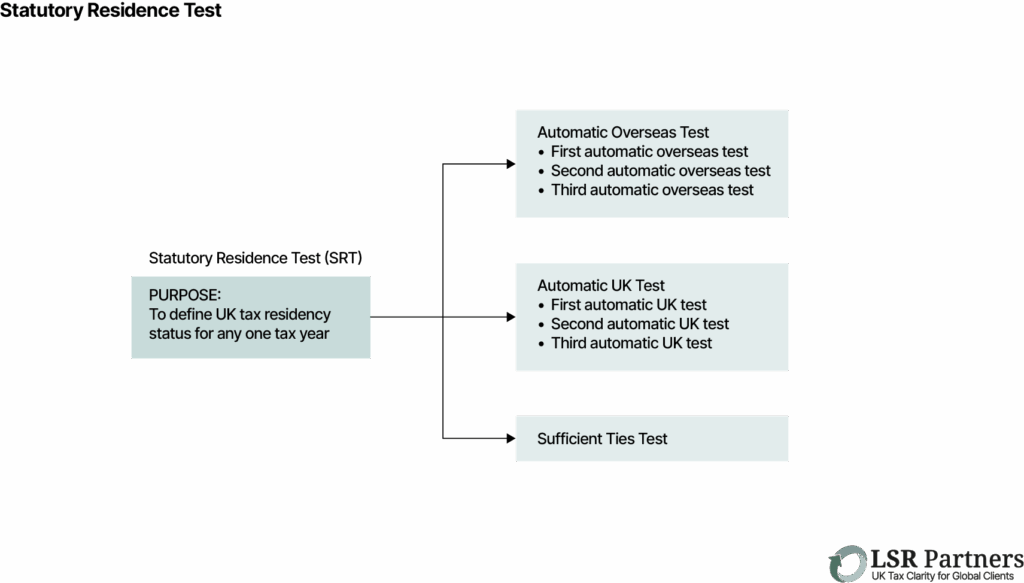

The SRT is the UK government’s framework for determining an individual’s tax residency each tax year. It looks at the number of days spent in the UK, personal and professional ties, and home ownership. The SRT is divided into three categories:

If you spend 183 days or more in the UK during a tax year, you are automatically a UK tax resident. But if you spend fewer than 183 days, you still need to consider other tests, including the second automatic UK test.

This test applies to individuals who may not spend long in the UK but still maintain a home here. You are considered a UK tax resident for the entire tax year if:

If these conditions are met and you do not qualify as automatically non-resident you will be treated as a UK tax resident, regardless of the number of days spent in the UK overall.

This rule often surprises people who:

While split-year treatment does exist, the criteria are very strict. Many individuals mistakenly believe they qualify, only to face unexpected UK tax liabilities later.

If you live abroad part of the year, own multiple properties, or are considering a move overseas, it’s essential to understand how the SRT applies to your situation. Getting this wrong could mean:

At LSR Partners, you get clarity and confidence. We explain exactly how these tests apply to your circumstances so you pay the right tax in the right place at the right time.

Don’t assume that fewer than 183 days in the UK makes you exempt. The second automatic UK test proves that tax residency rules are more complex than many realise.

If you live and work abroad, own property in the UK, or are planning a move overseas, now is the time to get expert advice. Contact LSR Partners today to make sure you stay compliant, avoid unnecessary tax liabilities, and plan your finances with confidence.

Contact LSR Partners today to speak with our expert team and pay the right tax, in the right place, at the right time.