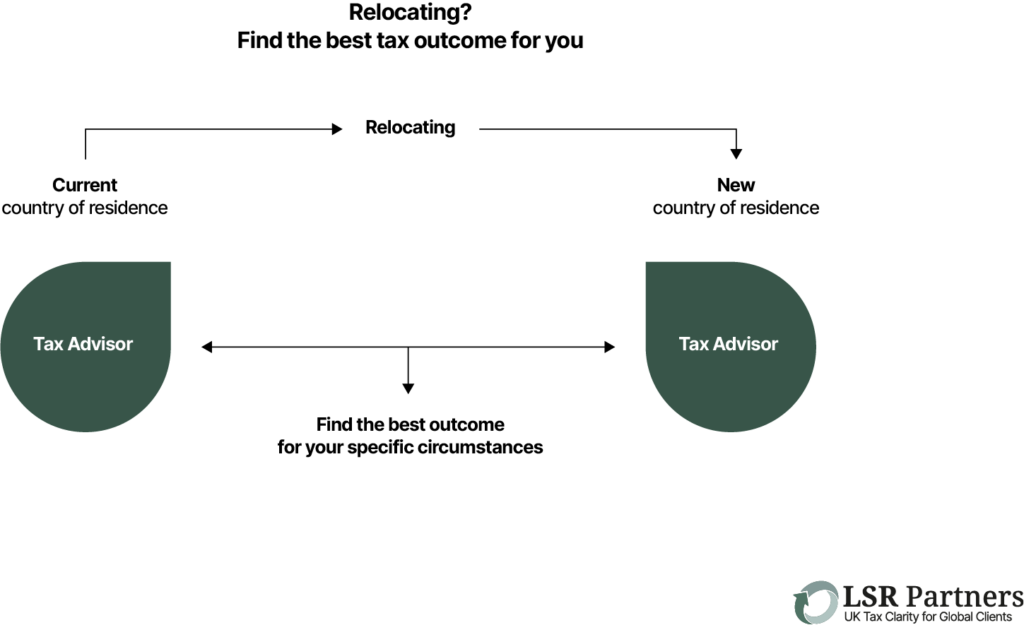

Tax liabilities and tax rules can vary significantly from one country to another. Without the right planning, you could find yourself paying more tax than necessary or missing out on opportunities to optimise your tax position. The best way to ensure a smooth transition is to consult with a tax advisor in both the country you’re leaving and the one you’re moving to, and make sure they collaborate on your behalf.

By working together, these advisors can fully understand your personal tax situation, considering both your current and future obligations.

Each advisor has insight into the rules of their own country, and can only see half of your tax picture, but when they communicate and share that knowledge, they can offer a comprehensive plan. This ensures you’re getting the full picture, avoiding double taxation, and making the most of tax relief opportunities in both jurisdictions.

We specialise in international tax advice and will coordinate with tax professionals in your destination country to deliver the best outcome for you.

We’ll ensure you minimise liabilities and streamline your financial relocation. Our goal is to make your move as financially efficient as possible, so you can focus on your new chapter without the stress of unexpected tax surprises.

If relocation is in your plan, then we can work with tax advisors in other countries to make sure that you pay the right amount of tax in the right way at the right time.

To hear how we helped one individual who was relocating away from the UK to realise his Capital Gains without having to pay any tax, watch the video below or go to: https://www.youtube.com/watch?v=xtfiu9sbhz0

UK tax clarity for global clients - Pay the right tax in the right place at the right time.

Any questions? Book a consultation!