For a more comprehensive deep dive see our latest Podcast out today on the abolition of the Non Domicile scheme and Overseas Workday Relief:

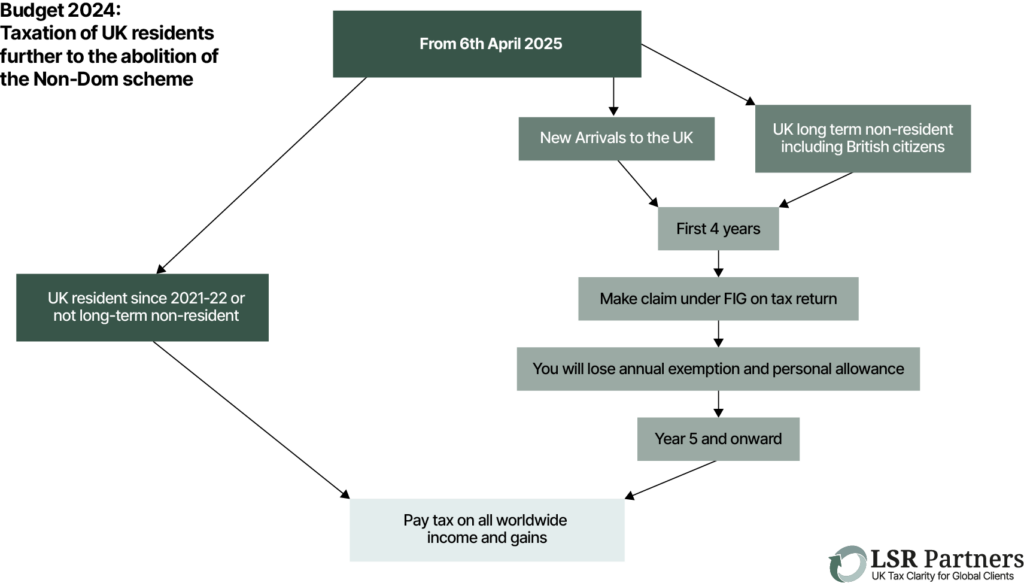

From 6 April 2025, the UK Government is abolishing the current tax treatment for UK non-dom* individuals.

This means that, from April onwards, if you are a UK tax resident, all of your worldwide income and gains will be taxed.

If you currently hold non-dom status**, this system will be replaced by a system based on an individual’s residence status. This new tax system will be available to individuals who have been non-UK residents for the past 10 years and will include British citizens who have been living abroad.

For the first four years of this new tax system any individuals new to the UK or UK non-residents can make a claim for tax relief under the Foreign Income and Gains Regime (FIG). Individuals will be able to make a claim on their UK tax return but when they do this, they will have to give up their Personal Allowance and will lose their Annual Exemption for Capital Gains Tax (CGT).

Once the four years are up, all worldwide income and gains for these individuals will be subject to UK tax.

In order to support individuals as they transition from one scheme to another, the Government have provided some transition rules. The impact of these rules will vary depending on everyone’s individual situation. We recommend that you take professional advice about how best to transition to the new scheme. Please see our Budget update on the Temporary Repatriation Facility, for more information: https://www.youtube.com/watch?v=4N082EP_dSE

As the abolition of the Non-Dom scheme will impact everyone with worldwide income, gains or assets differently, we suggest that you take expert advice about your personal situation as soon as possible.

As experts in the UK taxation system, we at LSR are regularly advising our clients who have business and financial interests overseas. So, if you have income or potential gains from outside the UK or if you own or could inherit assets from overseas, we recommend that you get in touch as soon as possible. There is still time before April for us to understand your financial affairs and provide tailored advice to give you the best financial outcome.

To see more of our Budget 2024 updates please go to:

Definitions:

*Non-dom (Non-domiciled) – this is an individual whose permanent home, or domicile, is considered to be outside the UK.

**Non-Dom status - this allows for UK residents whose permanent home is not in the UK, not to be taxed on foreign income and gains which are not brought into or used in the UK. This also includes not subjecting non-UK assets to UK Inheritance Tax when a non-dom dies.

UK tax clarity for global clients - Pay the right tax in the right place at the right time.

Any questions? Book a consultation!