Got a company car, private medical cover, or other perks at work? These are classed as non-cash Benefits in Kind, and yes, HMRC wants to tax them.

A non-cash benefit is a benefit received from an employer that is neither cash nor a cash equivalent.

Non-cash benefits in kind include, company car, medical benefits, dental benefits.

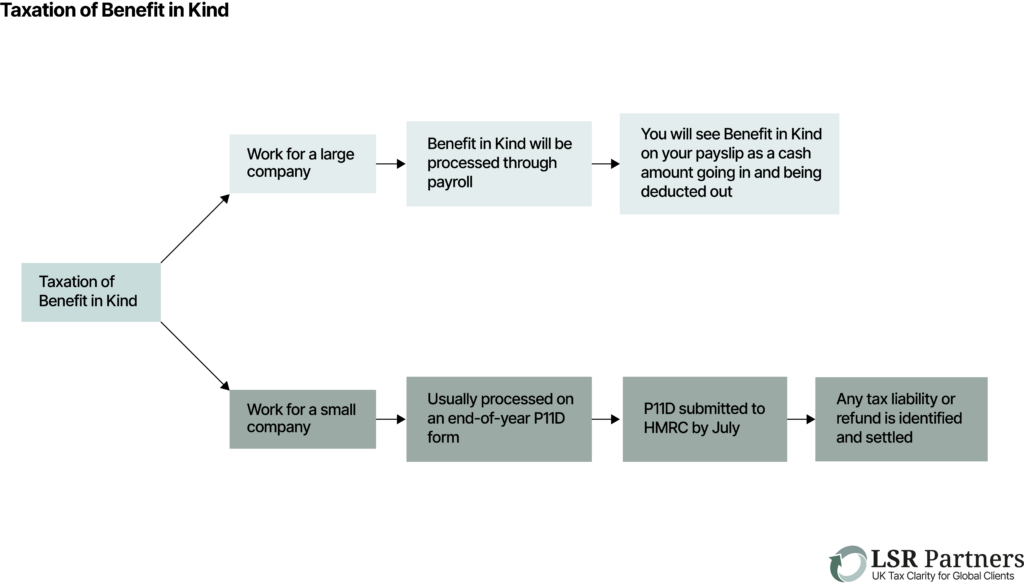

Benefits in kind are usually taxed in one of two ways, depending upon the size of your employer.

If your employer is a smaller company, most often, benefits in kind are processed at the end of the year using a P11D form. This form is submitted to HMRC by early July. Any tax liabilities or refunds are then communicated to you and need to be settled with HMRC.

If your employer is a large company, most often, benefits in kind are processed through payroll on a real time basis. You should see the benefit in kind included on your payslip each month as a cash equivalent which is taken out as a deduction as you do not physically receive the cash.

However, HMRC have announced plans to abolish the P11D process of declaring benefits in kind, by April 2026. This will mean that, by this time, all benefits in kind will need to be processed through the payroll as is the case for larger companies.

If you have any questions about benefits in kind, then please get in touch. We can provide tailored advice to make sure that your non-cash benefits in kind are being processed properly and that you are paying the right tax in the right way at the right time.

Contact LSR Partners today to speak with our expert team and pay the right tax, in the right place, at the right time.