Simon and Laura look at when the interest earned from savings needs to be taxed.

Here’s some information about taxing interest on savings that it is important to be aware of.

Before any tax obligations come into effect everyone is entitled to a Personal Savings Allowance.

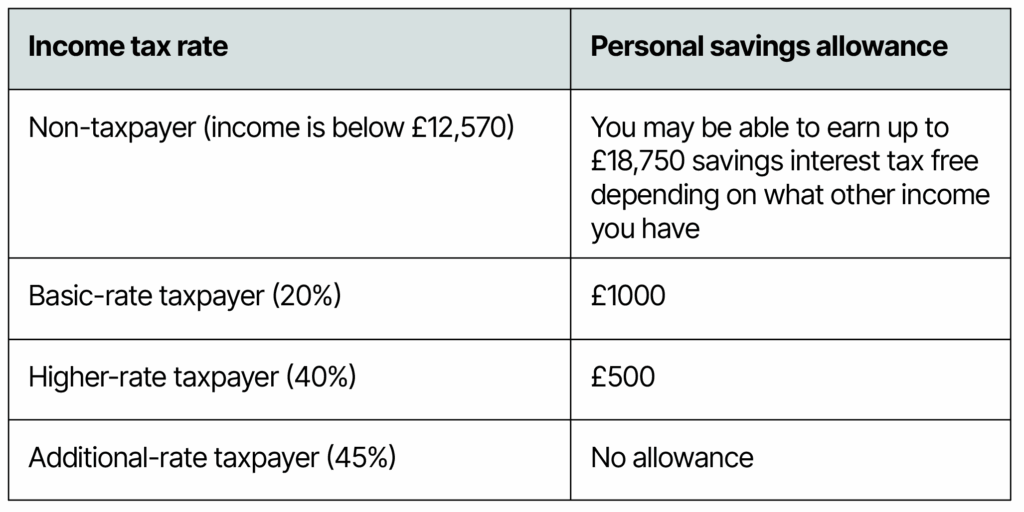

The Personal Savings Allowance (PSA) is a tax-free allowance which allows you to earn interest on savings up to a specific amount before you have to pay tax on it. The allowance amount is linked to your income tax rate. So, for example, if you are a basic rate taxpayer, you can earn up to £1000 in savings interest per year without having to pay tax on it. The PSA includes income earned from all savings accounts (except ISAs).

When your combined income and savings interest exceeds your Personal Savings Allowance, then you have to pay tax on it.

The table below shows how much interest you can earn on your savings before paying tax (your PSA) depending on your income tax rate.

Your bank or building society will pay all interest you earn from your savings accounts to you directly. However, while they will not deduct any tax from your savings interest, they are likely to inform HMRC of these payments they make to you.

There are a few different ways to inform HMRC of your savings interest:

If your tax code is changed to account for tax payments on savings interest and then your income from savings interest falls back below the PSA, you could find yourself overpaying tax as your adjusted tax code will remain in place until you inform HMRC otherwise.

However, if you realise that this has happened, it is still possible to reclaim any overpaid tax up to 4 years after the tax year in which the overpayments were made. You can either do this using your SATR or by contacting HMRC directly.

Providing your income does not exceed £17,570, you may also be eligible for a tax-free starting rate for savings which can be up to £5000 depending on the amount of income that you earn.

If you think that you might be eligible for this starting rate, then please get in touch and we can talk through your personal levels of income and advise how much of the starting rate you may be entitled to.

There is a lot to be aware of when it comes to paying tax on your savings interest and it could easily be something that you overlook if you are unaware of how your savings pot has built up over the years.

If you want further information or advice about your specific savings and personal tax obligations, then please get in touch. We are here to help you make the most of your savings while fulfilling tax requirements.

LSR Partners: Here to help you pay the right tax in the right place at the right time.

This article is for general information only. Tax rules can change and your circumstances are unique. Get personalised advice before acting.